Registration of temporary residence in Russia implies the payment of state fees to the country's treasury. Without this preliminary payment, it will be impossible to issue a RVP.

How much is the state duty

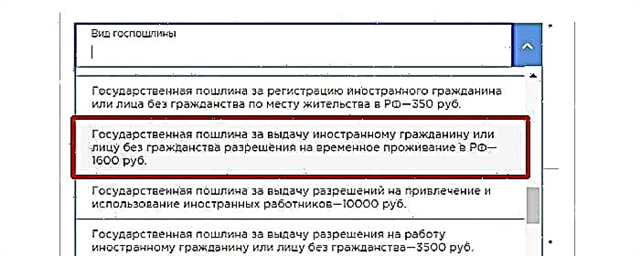

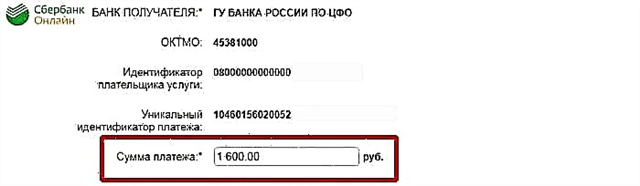

According to article No. 333.28 (clause 22) of the Tax Code of Russia, amended on 03/07/2018, the amount of this contribution for 2021 is 1600 rubles.

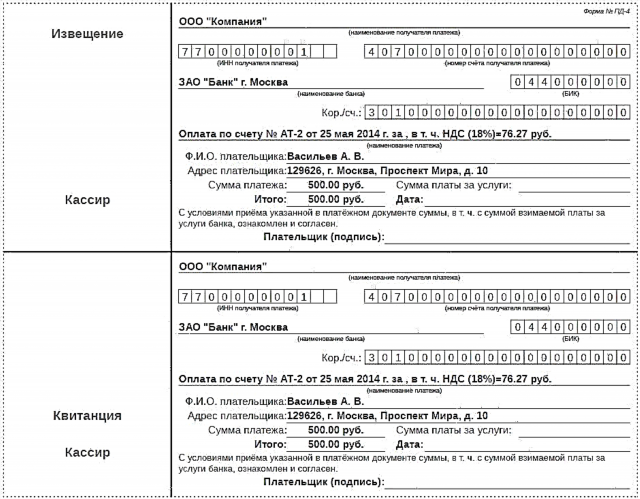

Where to get a receipt, how to fill it out correctly and where to pay

A receipt of format No. PD-4 is purchased at the department of the Main Directorate of Internal Affairs of the Ministry of Internal Affairs (or on the website of this department with a subsequent printout), which made the registration of the RVP document to the interested person.

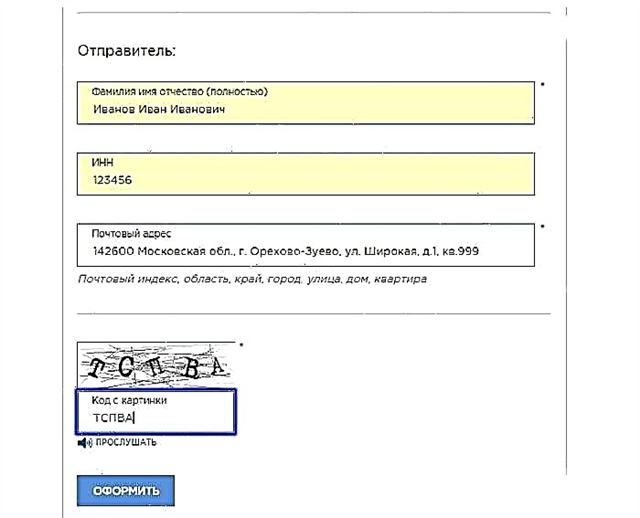

In the form (paper or electronic version), you need to enter the payer's details:

- UIN (unique identifier of accrual). Assigned by the territorial tax authority (Federal Tax Service of the Russian Federation). You can find out about its availability at your local tax office or on its website. The placement of the UIN in the contribution form is accompanied by an indication of the purpose of the payment, separated from it by three oblique lines. If the payer does not have a UIN, instead of the number, put the number "0";

- FULL NAME;

- Place of registration;

- TIN;

- Signature.

The date on which the payment was made should be at the bottom of the form. All information is entered in block letters with an ink pen. The form has a duplicate (both copies are filled in in the same way).

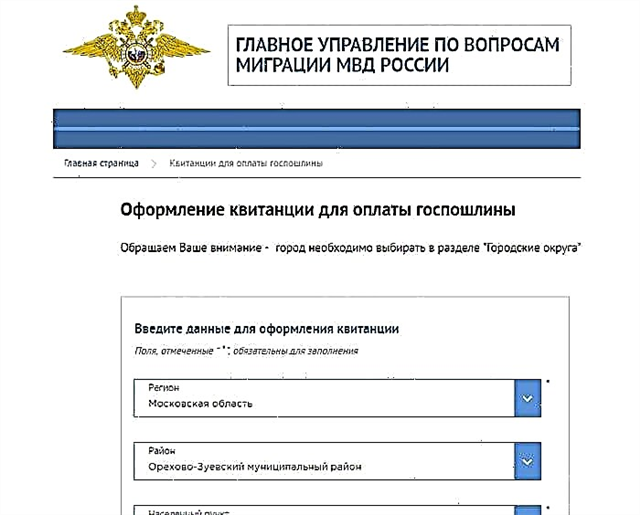

You can issue an electronic form with subsequent printing on the website of the Main Directorate of Internal Affairs of the Ministry of Internal Affairs:

2. Select a region, district, settlement;

You May Also Like

3. Select the tab marked with a red rectangle;

4. Fill in the fields;

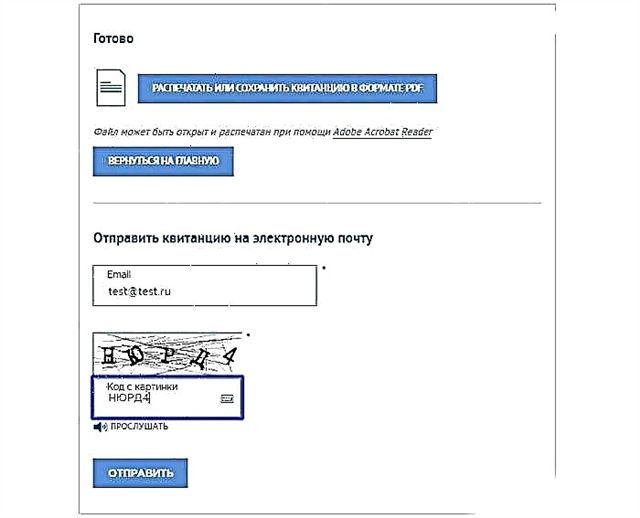

5. Perform any of the proposed actions with the receipt.

Payment can be made at the following locations:

- Bank branch;

- Postal site;

- Sberbank ATM;

- Sberbank-online portal.

The validity of the receipt and how to pay for it

According to article No. 333.40 of the Tax Code of Russia, the state duty on the temporary residence permit can be returned to the payer in full or in part within 3 years. Refunds are made by the Federal Treasury body within one month from the date of submission of the relevant application. When returning the full amount, the applicant must present a receipt of payment, part of the amount - a photocopy of the receipt.

The reason for the return of the deposited amount may be a change:

- Payer's details (including due to an error when filling out a receipt for payment);

- The amount of the duty (established by the order of the Ministry of Internal Affairs);

- RVP certificates (expired, suspension, loss).

The length of the period between making this contribution and registering temporary residence in the Tax Code is not spelled out.

You May Also Like

When paying the fee at a bank or post office, you must submit the completed receipt together with the required amount of money to the reception office and present your passport.

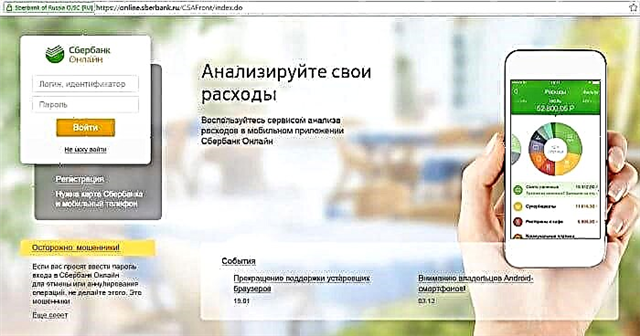

To pay the duty online (you can use this method only if you have an account on the Sberbank-online website, a Sberbank card and a mobile phone):

1. Go to "Sberbank-online" and go to your personal account;

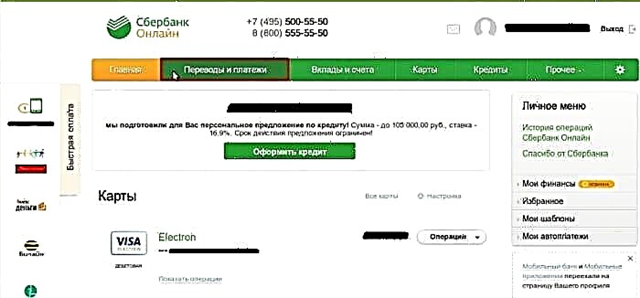

2. Click on "Transfers and Payments";

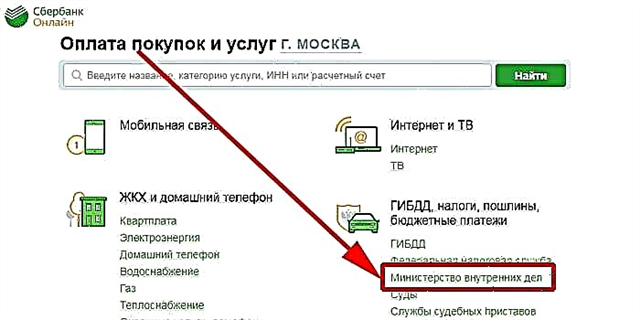

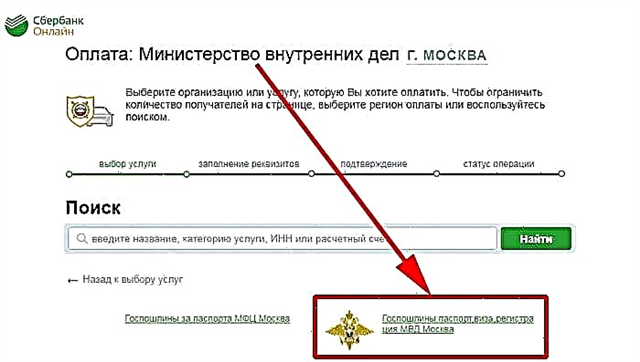

3. Enter the "Ministry of Internal Affairs" tab;

4. Further in "State duties: passport, visa, registration of the Ministry of Internal Affairs of Moscow";

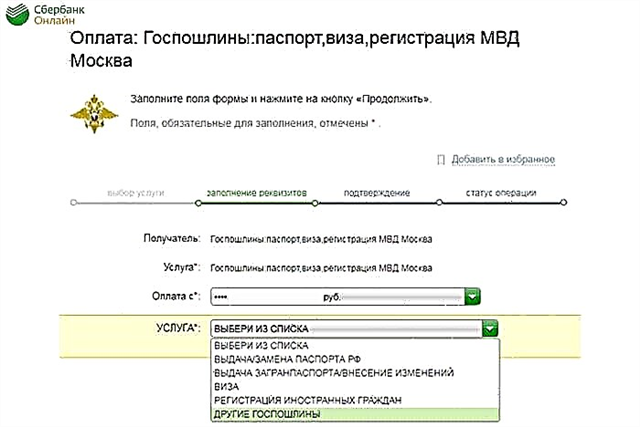

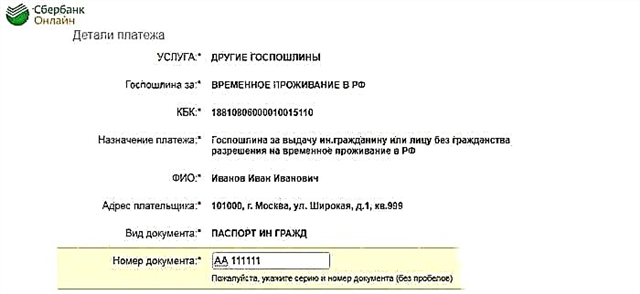

5. In the list of services select "Other state fees";

6. From the proposed list, select "Temporary residence in the Russian Federation";

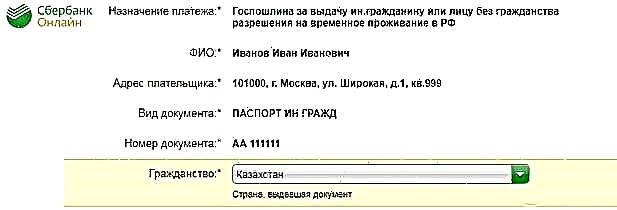

7. Enter your full name, address, type of document (passport) and its series and number in the appropriate fields;

8. Indicate citizenship;

9. Confirm the fact of payment;

It is better to print the received receipt and keep in case of claims from the tax or immigration authorities.

When paying the fee at a Sberbank ATM, a number of manipulations should be performed:

- For initialization, insert a plastic card into the hole and enter the PIN-code;

- Select "Payments" in the offered menu;

- Go to the section "Taxes, fines, duties";

- Click on "State duties and fees";

- Indicate the recipient of the payment (department of the Ministry of Internal Affairs), specifying its location (name of the city, region, region). In determining the required unit, its name, TIN or barcode, available in the receipt, will help;

- Enter your full name, passport number, TIN;

- Choose a type of duty (for RVP);

- In the window that opens, enter the recipient's TIN (specified in the receipt) and click "Continue"; then, after displaying the name of the addressee - "Select";

- Select manual input of money, then - "Continue";

- Go to the payment window and perform the operation by placing banknotes in the receiver.

You need to pledge the exact amount without overpaying, since the ATM does not give change.

What to do if the receipt is erroneous

If an error is found in the details specified by the payer and the purpose of the payment, a new receipt must be filled in before the payment is made. If an inaccuracy is discovered later, the payer must notify the department of the Main Directorate of Internal Affairs of the Ministry of Internal Affairs, and then return the amount paid and pay the fee again, following the instructions described above.

By paying the state duty in Russia, a foreign citizen assumes the role of a law-abiding taxpayer. Having received a permit for a temporary residence permit, he will have the right to demand certain privileges from the state (for example, unlimited free medical care), which will make the completed monetary transaction profitable for him.