Immigration, decent medicine, and high average earnings play the main role in the issue of American demographics. Taxation in the country is complicated, therefore strict accountability must be observed.

Economic situation and incomes of the population today

The US economy has shown steady growth since 2010. GDP has not lost ground for 10 years, which allows analysts to make favorable forecasts. The domestic market is divided among solvent buyers. In this regard, large companies are gradually coming out of the crisis.

The following industries are developed in the United States: mechanical engineering, metallurgy, engineering, shipbuilding, raw materials, and the agricultural sector. Production volumes are only partially concentrated in the states, the bulk of the capacity is transferred to China. The service industry in America prevails over the industry. This is the ideal scheme of the post-industrial economy, according to local experts.

Salary per month by occupation in 2021

In terms of the income of the population engaged in hired labor, the United States maintains a leading position in the world market. Foreigners find in the states the opportunity to provide themselves and their families with a quality life with a stable income.

- The average annual salary in the United States is highest for a doctor (over $ 200,000). Highest paid medical professionals: anesthesiologist (251300 $), surgeon (240350 $), obstetrician-gynecologist (215760 $), therapist (200530 $), psychiatrist(190100 $), neurologist (190040 $).

- Programmers are slightly less well off - income in 12 months from 130100 $.

- Architects and designers receive on average per year 130500 $... In the same row are pharmacists, pharmacists, power engineers. Their salaries from $ 131,200 to $ 135,150.

- In the American labor market, prestigious vacancies are always available for IT specialists, SEO administrators, and mobile service developers.

- Professional tax agents, community managers, and marketers are counting on fast career growth.

Table 1. Average salary in the United States by profession per month.

| Speciality | Average earnings, $ |

| Anesthetist | 21000 |

| Architect | 10000 |

| Accountant | 1100 |

| Driver | 800 |

| Military | 12000 |

| Doctor | 10500 |

| Loader | 600 |

| Street cleaner | 500 |

| Detective | 1500 |

| Mason | 1200 |

| Engineer | 1300 |

| Nurse | 1100 |

| Waiter | 1200 |

| Security guard | 1300 |

| Paramedic | 9300 |

| The hairdresser | 400 |

| Cook | 450 |

| Fireman | 1450 |

| Policeman | 3000 |

| Psychologist | 1800 |

| Salesman | 500 |

| Worker | 400 |

| Plumber | 400 |

| Welder | 800 |

| Builder | 900 |

| Taxi driver | 800 |

| Tester | 2000 |

| Turner | 1200 |

| Cleaning woman | 600 |

| Teacher | 2100 |

| Scientist | 3000 |

| Surgeon | 12000 |

| Miner | 4000 |

| An electrician | 1500 |

| Lawyer | 3000 |

Minimum

The lowest hourly wage in the United States, translated into Russian currency, is 474 rubles... Order 40% states maintain minimum wages in the range 9.2-10.5 dollars at one o'clock. Trainees, students, migrants have the opportunity to earn within these rates, even with part-time employment from 120 $ in Week.

You May Also Like

Average

Salaries in the United States vary from location to location, depending on qualifications, prestigious education. If you look at the statistics for the country, then the American average rate is 850 $ in Week (780 $ for women and 920 for men).

Average starting salary

If a newly-made resident of the United States does not have unique abilities, is not an example of a valuable specialist, then you can make money on the profession of a maid, waiter, bartender, office clerk about 250 $ in Week.

The most promising areas in the labor market in 2021 were named: rental housing, insurance agents, programmers, lawyers.

Maximum

An American's earnings are unlimited. Show business tops the elite list of professions along with eminent athletes, bankers, political leaders, managers of large companies, businessmen. For persons engaged in such activities, income is measured in several hundred thousand dollars a month.

In more practical areas, doctors are leading. From 8 to 10 million in Russian rubles a surgeon, therapist, gynecologist, obstetrician receives a year. Anesthesiologist and dentist are estimated at 4 million more. We are talking about professionals, but in comparison with the world salary ranking, local doctors are rated at 60% higher, even within ordinary practice, than in the same prosperous Europe.

Labor remuneration by city and region

The level of remuneration depends on the area of residence. Over the past 10 years, Alaska, Washington, Virginia, Connecticut, Maryland, and New Jersey have been leading in this indicator. Decent median income figures have been recorded in California, District of Columbia, Massachusetts, Minnesota.

In the listed districts, the average daily salary is calculated from 700 rubles per hour of working time. This minimum threshold is prescribed by law.

The American Labor Code prohibits infringement of the rights of employees on the basis of religious, ethnic, class, intellectual, or physical characteristics. Enterprises are obliged to provide the employee with conditions under which equal rights and opportunities are guaranteed.

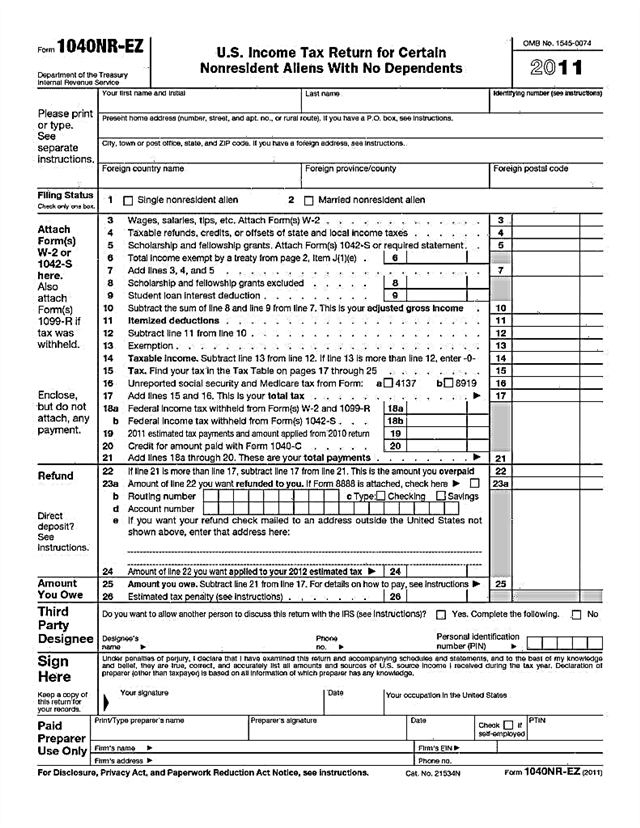

Payroll taxes

You May Also Like

A third of the income of an ordinary citizen of the states goes to pay the tax burden. When it comes to official work in the United States, there is a list of taxes that are required for each:

- Federal Income Tax from 10% before 39,6%;

- Social Security Tax 6,2%;

- Medicare Tax (old age health insurance) 1,45%;

- State Tax from (state tax) 0% to 11%.

Late payment is fraught with a threefold fine. It is extremely difficult to prove special personal circumstances in court. It is worth observing the deadlines, filling out the forms correctly, without blots and edits.

Income tax

The average American in the United States is obliged to file a tax return with the department annually in accordance with the established procedure - this is a voluntary fiscal procedure. There is also a compulsory form of levying income tax, which provides for withholding a percentage of wages. The deadline for payment is legally specified - until mid-April next year.

US citizens are subject to state taxation even if they reside outside the country. Long-term stay within the state also classifies a person as a mandatory taxpayer. The change of citizenship will get rid of the tax only after 10 years.

At the end of each year, anyone eligible to work in the United States must complete a Tax Return Form. Legal advice or assistance in filling out documents is provided by qualified specialists for a fee ($58-62)... It is easy to find a service in large shopping centers, office buildings.

It is possible to fill out the forms yourself on the Internet resources (online applications, free electronic services).

Social contributions and other taxes

Families with two members are exempt from paying federal tax. If their income no more than 18000.

Minimum tax deductions are minimal for:

- vehicle ownership;

- medical insurance;

- union dues.

The total cost will be no more than 10 $ per monthclose these deductions once a year until mid-April.

Each district collects monthly contributions for social needs (church, educational, utilities, garbage collection, sidewalk repair, landscaping, etc.). The costs will be from $ 3 to $ 5.

State Tax in some counties is fixed, that is, the percentage does not depend on income. Sometimes the percentage fluctuates from the profit - the more earnings, the higher the fiscal rate. In half of the states, the burden of this payment has been canceled altogether (Washington, Florida, California, Alabama).

The ratio of salary and living expenses

How much a person earns and will depend on his comfort.

Gasoline in the USA costs about 30 rubles per liter.The condition of the roads is overwhelmingly decent, but there are many toll road sections.

Utilities depend on the level of the property. The average family of two spends a month on water and electricity bills about 30$... Elite housing will come out on order more expensive (from $ 300).

- The most expensive in 2021 will live in San Francisco - there is the highest consumer price index in the United States.

- Honolulu and New York ranked second and third, respectively.

- The top twenty also includes such large cities as Washington, Albany, Stamford, Las Vegas, Chicago, Boston, Philadelphia, Anaheim and Seattle.

The average bill in an ordinary Boston restaurant will be in 15 $ per person, a cup of cappuccino somewhere in Miami - in $4and the monthly rentals of a one-bedroom apartment in downtown New York are at about 2965.

If we take into account the obligatory expenses and deductions, then the average residence in the country will come from 150 $ in Week. To exist as a family of husband and wife on $90000 more than acceptable. This will provide a decent standard of living. Quality food, car, medicine. Of this amount, the price of insurance and taxes will be 24000 $... This is a big expense. If you add to the parents the expenses for the education of children and other needs, then the income does not seem so worthy anymore. However, it is not loyal to compare it with the CIS countries.

Unemployment Rate and Prospects for Migrants

The number of unemployed in the country is declining, but the rate of job creation has slowed down by about by 50 thousand in relation to 2017. The Federal Reserve System takes a position on price regulation, keeps inflation in check.

In the United States, visiting scientists, narrow specialists in the field of medicine, microbiology, cybernetics, and nuclear physics are readily accepted. The government shows its interest in young personnel, all kinds of student distribution programs help foreign residents find work after graduating from the states.

Therefore, migrants arrive in the country with enviable constancy. Interns, students, young people who have come to work, choose ancillary work, fill those niches where Americans are not used to bothering themselves. A cleaner or a waiter without proper experience and education in the province may well rely on profit. from $ 250 per week. The inevitable costs will be from $ 180.

America is remarkable for its contrasts. In general, the local population has a high annual income. But taxes and labor laws have a number of subtleties specific to Russia. And also a great advantage of living in this country is the protection of citizens by law, as well as medical and social security.