Business immigration to the United States can be both a way to expand sales markets and increase income, as well as a convenient loophole for quickly obtaining citizenship. Small and medium-sized business owners can obtain special business visas, which are almost similar in capabilities to a green card.

General information about business immigration in the USA

A ticket to America on a business visa is one of the easiest ways to get the right to live, work and study in the country, bypassing many bureaucratic barriers.

What is business immigration

Simplified relocation to the United States is possible for small business programs. Since the Obama presidency, the United States administration has been doing everything it can to bring manufacturing back to the country, as well as to support mid-range foreign investors and entrepreneurs.

By themselves, business visas do not entitle you to a residence permit, citizenship or something similar. But if the business is successful and benefits the local economy, the residence permit request is more likely to be resolved positively.

What is a business visa and what type of visa you can get in the USA

A business visa is a permit to visit and stay in a country with the aim of developing one's business.

Today, among Russians and residents of the CIS countries, three options are especially popular:

- Program EB-5 for investors;

- L1 visa for managers and senior executives working in the American branch of the company;

- Investor visa E2 (only for countries that have an agreement with the United States).

Each of the programs gives access to visiting and living in the country not only for the migrant, but also for his entire family.

What type of business is more profitable to open in the USA

You May Also Like

To work from scratch, businessmen are advised to go into a service sector or activity with high requirements for professional skills.

According to statistics over the past ten years, the United States will be happy:

- Accounting and legal offices;

- Farmers and agricultural organizations;

- Specialized retail stores;

- Paid clinics.

Important! Investment programs do not provide for a risk-free business as a basis for obtaining a green card. Simply put, an investor visa will not be issued for another credit organization. Otherwise, there are practically no restrictions.

You should not engage in services that do not require special qualifications. To open another barbershop, you will have to withstand fierce competition with the locals, who have already divided clients among themselves. Also, there is no need to set up an ordinary store without some zest - shopping centers are at every turn, and you will hardly be able to fight them at a price.

In general, the risks are the same as in any country in the world. Price, convenience, skill of specialists - if everything is available, then even the next eatery opposite will pay off KFC.

US Immigration Conditions for Entrepreneurs

The set of documents and specific requirements for a migrant depend on one of three types of visa. When obtaining a visa, you will need:

- Confirmation of the establishment or purchase of a business in the United States;

- Confirmation of the fact of investment for the amount specified in the visa requirements;

- Documents proving the fact of participation in the enterprise by investments for two years;

- A statement certifying the number of permanent employees of the company at the time of the creation of the business and at the moment.

Choosing the required visa and the conditions for obtaining it

The easiest and most convenient option for obtaining a green card will be visa EB-5... This program started in 1990 as a project to attract additional foreign investment to the United States economy. Annual program quota - 10 thousand visas, but the entire volume, as a rule, remains open, so that the applicant is always considered as quickly as possible.

For getting EB-5 a businessman must invest from 500 thousand to a million dollars in American companies. Lower limits are typical for the central, agricultural regions of the country.

This option is suitable for people with significant income who decide to set up a branch in the United States or invest part of their funds abroad. The investor does not have to participate in asset management, and after two years, if the conditions are met, he will receive the status of permanent residence.

You May Also Like

Minuses:

- Noticeable expenses;

- Long term of verification and registration;

- The need to live in the States for at least 6 months a year.

L1 visa significantly simplifies relocation when setting up a foreign branch. To obtain the status you need:

- Organize a subsidiary company or acquire an existing American company as a branch;

- Document the actual work of the office in the United States;

- Have at least a year of managerial experience in the main company;

- Hire at least 3 employees in the first year;

- Demonstrate the flow of funds between headquarters and subsidiaries.

Here it is important to demonstrate the successful functioning of the office after a year, as well as the quality of the work of the specialist himself. From the pros:

- Much lower expenses for monthly office work;

- Prospects for obtaining a full-fledged green card after a year of work.

Of the minuses - it is necessary to show real results of work, for an office of the "Horns and Hooves" level, the applicant may lose a visa without the right to renew it.

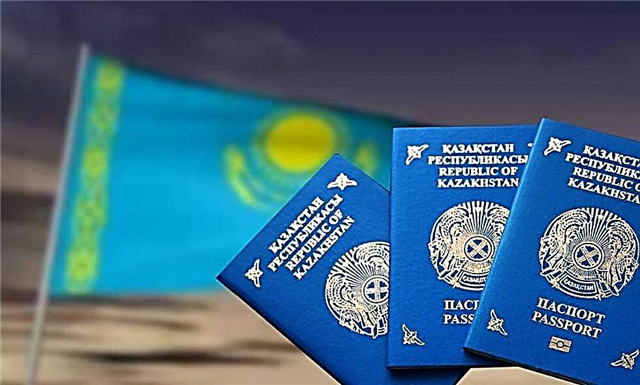

Investorskaya E2 visa suitable for residents of most countries of the USSR, except for Russia and Belarus, with which the treaty has not been ratified. This limitation can be circumvented by changing Russian citizenship to Kazakhstani or by obtaining a second passport of Grenada. Investment amount as opposed to EB-5 low - from 50-100 thousand dollars. E2 - the cheapest and easiest option for a businessman to live in the United States.

The advantages are:

- Lack of quotas for jobs;

- Softer conditions for checks;

- Fast visa processing.

Minuses:

- The status is issued for only two years (with the possibility of extension);

- E2 by itself does not lead to a green card;

- Business management requires a lot of time.

Conditions for obtaining a residence permit, permanent residence, citizenship

The organization of a business visa, even with the absence of an option for immigration, will seriously simplify obtaining a residence permit and citizenship.

The standard layout looks like this.

- A company opened in the United States sponsors a prospective migrant to obtain an L1 work visa;

- A foreigner can acquire temporary residence status for a period of one to three years. In the same period, it is possible to receive a green card;

- The spouse and minor children of an L1 holder will receive an L2 visa for accompanying persons. This visa will allow you to live and study in the country without restrictions;

- One year after receiving L1, the migrant is entitled to a priority residence permit.

Important! L1 is not an emigrant visa, therefore, when applying for a visa, you should not talk about your desire to permanently move to the country.

Buying a ready-made business and starting from scratch

The convenience of investor business visas is that a migrant does not have to organize his own branch of the company from scratch. He can simply buy out an existing company, changing its legal status.

Buying a business instead of starting it increases the visa period (from one to three years) and simplifies the legal red tape with confirming the reality of the company for the migration services.

Investors can invest in Regional Centers - specially created under the program EB-5 economic institutions.In this case, you will not have to worry about the organization and operation of the business at all, but you will need to ensure that the Center does not go bankrupt, and the number of jobs created thanks to the invested money is more than ten.

What business options in the USA are most common among Russian immigrants

According to statistics, Russian emigrants prefer to open a business related to the service sector:

- Car washes;

- Coaching;

- Building bussiness;

- Car repair.

The choice of services depends on the specific state and the starting capital: if pharmacies and repair shops are popular in New York, then in Los Angeles you should think about a gym or a security company.

A simple option would be to buy a franchise - a small part of a large network in compliance with the rules set by the franchisor. This will give you the opportunity to join a chain of stores with a recognizable brand, but you will have to pay significant royalties to use it.

The restaurant business has the most notable return on equity, with an average of from 20 to 25%. Of course, only successful companies are considered - the competition in this area in the United States is simply incredible, dozens of small firms burn out every day.

Business ideas with minimal investment

The smallest investments require projects, a significant share of which is the work of specialists. The list of businesses that require only a head on their shoulders and a minimum of equipment include accounting companies and internet businesses.

A private dental clinic can literally make a good doctor rich. Yes, the equipment and license costs will be quite high, but they will be repaid with a guarantee in the first year.

Chiropractors show the highest profitability: their work is generally recognized by medicine, and only a license and a relatively small office are needed to work.

In the United States, there is a widespread market for investment and stock exchange advice, as well as assistance in paying taxes. Two or three people at the right time and place can start a new financial empire.

And of course, small networks for essential services in the central states. A good auto repair shop practically cannot burn out in conditions when two cars per family are considered the norm.

Legal nuances

In addition to obtaining a business visa, there are a number of nuances in registering and managing the company itself. Let's consider the main features.

Business registration

There is no single federal body for registration of companies. Each state decides this issue independently, regulating business issues.

Nevertheless, the procedure for registering a company is practically the same everywhere and is solved in three steps:

- Submitting an application to the secretary of a state or government agency that performs his duties in a particular state;

- Registration with the IRS (tax office), obtaining a tax registration number;

- Opening an official company account in an American bank.

Four forms of doing business are available for work:

- Self employed;

- Partnership;

- Corporation;

- Limited Liability Company.

Each form differs both in the characteristics of the organization and in reporting with the payment of taxes.

Taxation

Taxes in the United States are divided into three tiers:

- Federal;

- State taxes;

- Local.

All firms operating in the United States are required to pay federal taxes. The scheme is progressive: the greater the company's profits, the more money it is obliged to pay to the tax authorities. The percentage ranges from 15% with less profit 50,000 dollars before 35% at $ 18.3 million and more per annum.

State taxation is highly dependent on domestic corporate law. In general, the tax can range from 0% (as in special zones of Nevada) to 12% (rate for a high-yielding business in Iowa).

Finally, local taxes are collected directly by the city or area. Usually the local tax is quite low, from one hundred to a thousand dollars a year, but it is better to find out specific details on the spot, in the city administration.

Other nuances

Under US law, business management in the country is completely outsourced to the state. That is, a particular state can establish rules for registration, maintenance, additional taxes and fees.

The only requirement of the federal government is that regional business laws should not contradict the laws of the country. Otherwise, the Treasury and IRS they withdraw themselves, resolving issues only with federal tax.

This has led to very confusing local laws. It should be said that each state separately licenses lawyers for financial law, and a person with an Alabama license is not allowed to practice in New York - the laws are too different.

You should not chase a tax-free rate or, on the contrary, choose a state with a very tricky payment scheme. This usually leads to problems with legislation and a huge loss of time. A person who wants to emigrate to the United States with the help of business does not need such reputational problems.

Tips for American Business Immigrants

In the experience of immigration compatriots on investor visas, the following things should be avoided:

- Deliberately providing incorrect information. Each of these points in the documents is like playing Russian roulette. Any mistake can lead to the cancellation of the visa and the ban on entry into the country. It should be remembered that for the first three years, each business visa holder is under increased supervision, and all his documents are not trusted by default.

- Opening of fictitious branches. The unprofitable "Horns and Hooves", through which the money of the main business is only spinning, can become a ticket to the United States. But with this approach, it will take so much money for documents, taxes and financial transactions that it will be easier to take an investor visa for $ 2 million and really make money. If the fictitious branch does not do anything at all, the business visa will simply not be extended.

- Violation of the law in one form or another. Until a residence permit (or even better, citizenship) is received, a non-resident should avoid breaking the law even in the smallest detail. One drunk trip can put an end to several years of work.

- Tax evasion. Highlighted as a separate item because of its seriousness. Those wishing to emigrate are strongly discouraged from trying to hide taxes with semi-fraudulent schemes. Even if it is legal (or almost legal), both the tax and migration services will put a mark in the personal file, after which it will be much more difficult to obtain citizenship.

Business immigration to the United States is a long and difficult business. The applicant should tune in to a long marathon, where the purity of his investments will be checked annually, and any mistake, at best, will roll him back to the very beginning.

Features of emigration to the country on a business visa can be viewed in this video.