The presence of an insurance policy is the same necessary condition for visiting any of the countries of the Schengen zone, as the presence of a passport and a Schengen visa. Medical insurance for a Schengen visa allows you to avoid many serious financial and organizational problems in force majeure situations that may arise during your trip. Moreover, we are talking not only about a sudden illness, injury or injury, but also about the loss of luggage and documents. Let's take a closer look at what insurance to choose for a trip to the Schengen area and what to look for when registering it.

Why do you need medical insurance

In 2021, the entry of Russians into the territory of 26 European states that are part of the Schengen zone is possible only if they have one of the types of Schengen visas.

The most common type of Schengen visa is category C single and multiple entry short-stay visas.

Such visas can be issued by Russians who want to make a tourist trip, visit relatives and friends, solve a business-related issue, visit their real estate in Schengen countries, etc. Schengen visas are pasted into the passport and contain information about the zone and duration of the entry permit, the duration of stay in the Schengen area, full name of the owner, the purpose of issuing a visa.

More detailed information can be found in the article: "Schengen Visa".

According to the decision of the European Parliament and the Council of the EU (Regulation EC No. 810/2009 of 13.07.2009), in order to open a single Schengen visa, each applicant must provide a tourist medical insurance valid for the entire period of stay in the Schengen zone for a minimum amount of 30 thousand euros.

When opening a multiple-entry visa, you will need insurance for the first visit and a written commitment to issue it for each subsequent trip.

What insurance should include for a Schengen visa

Medical insurance for a Schengen visa must cover costs of at least 2 million rubles or 30 thousand euros.

This is necessary for Russian citizens who are going to travel abroad. According to Art. 1 and 2 of the Law of the Russian Federation No. 155-FZ "On Amendments to Certain Legislative Acts of the Russian Federation" dated 29.06. 2021, the state strongly recommends voluntarily concluding health insurance contracts with insurance companies.

All costs associated with receiving emergency and other medical care abroad are fully borne by the victim. The state will pay only for those victims who are on a business trip, in accordance with international treaties and the current legislation of the Russian Federation.

Insurance for obtaining a visa to one of the countries of the Schengen zone, according to the requirements of the European Parliament, must:

- act throughout the entire period of stay of the insured person in the Schengen area. Many insurance companies include an additional 15 days in the policy free of charge - the so-called corridor. This can come in handy in the event of a change in the travel date. Holders of multivisa who make frequent short trips abroad, it is more profitable to issue an insurance policy for a whole year at once - this will save time and money;

- cover all countries of the Schengen area;

- have a zero deductible;

- in case of an insured event, cover at least 30 thousand euros.

The standard insurance policy for a Schengen visa reimburses the costs associated with:

- medical examination, outpatient and inpatient treatment;

- the purchase of prescription drugs;

- transportation of the patient to a medical institution;

- provision of emergency dental care;

- medical transportation of the patient home;

- repatriation of the body of the deceased to their homeland;

- communication with the service center of the insurer (international communication);

- evacuation of underage children left without supervision to their homeland in case of hospitalization of a parent or guardian.

It should be borne in mind that the basic insurance policy for a visa to the Schengen countries with a limit of 30 thousand euros covers only the costs associated with minor illnesses and minor domestic injuries.

Sports and other active types of recreation carry the risks of serious injuries requiring more expensive treatment. Therefore, a tourist who has taken out standard insurance for himself and goes to a ski resort may be denied a visa or not allowed to pass him at the border control.

When choosing an insurance policy, it should be borne in mind that travel abroad insurance (TCD) may include not only reimbursement of medical costs, but other unforeseen expenses associated with the loss of luggage, flight cancellation, robbery. Depending on personal circumstances, when taking out insurance, you can choose additional options.

Insurance companies offer a variety of additional insurance products for the client to choose from:

- a trip by private car - the policy may include compensation in case of an accident, accident, payment for the services of a lawyer, delivery of spare parts, etc. It should be borne in mind that in the event of an insured event, the presence of alcohol in the blood will deprive the insured driver of the right to compensation for the loss;

- active recreation - skiing, surfing, diving, mountaineering, trekking, cycling, scooter trips, etc. As a rule, it includes payments in cases of injury, disability, death;

- trip cancellation insurance. Many tourists plan their trips several months in advance. This allows you to get guaranteed hotel reservations, buy tickets at a discount. But plans can change for any reason. The policy will help to compensate for the money spent on tickets and reservations;

- insurance against natural disasters - avalanches, floods, tsunamis, earthquakes, forest fires, etc .;

- luggage insurance. The amount of insurance from 300 to 2000 US dollars allows you to compensate for the loss, theft, and damage to luggage. Baggage will be considered lost if it is not found within 14 days.

Airlines, services of which tourists use, are also responsible for the safety of baggage. In the event of its loss or theft, the airline compensates for the purchase of basic necessities in the amount of USD 50, and in case of unsuccessful searches - USD 20 per kilogram of baggage weight.

Special insurance requirements for some Schengen countries

In addition to the standard requirements for an insurance policy, each Schengen state may have its own rules. For example:

- in Austria, Denmark, Latvia and some other countries, a 15-day “corridor” of insurance is required;

- in Finland, the countdown of the validity of the insurance policy begins from the moment of submission of an application and a package of documents for the issuance of a permit to enter the country. Finns also require a receipt stating that there are no suspensive restrictions on the use of the insurance policy (for example, when the policy comes into effect after paying with a certain card or making a purchase);

- all tourists, both adults and children, entering Austria from November 1 to April 30, must include in the insurance policy "Skiing" or attach a free-form statement in English or German that the trip is not related to visiting ski resorts;

- German consulates request color printouts of insurance policies;

- in the Czech Republic, Estonia, France do not accept handwritten insurance policies.

Full information on the specifics of insurance can be obtained directly from the embassy, consulate or service center of the country where the trip is planned.

Where to go and how to properly arrange

There are several ways to get insurance for a Schengen visa.

The first way - the traditional and most reliable - is to buy insurance for a visa at the office of the insurance company. During a personal visit, you can get comprehensive advice on all issues of interest, choose the optimal set of insurance services in accordance with the timing, purpose of the trip, and financial condition. Refusal from irrelevant services will significantly reduce the price of the policy.

The second method is most often used by tourists - an insurance policy is purchased from a travel agency at the same time as the voucher. The advantages include the minimum prices and the fact that in most companies, managers are well aware of the requirements for insurance policies and will help you quickly arrange insurance.

Among the disadvantages is poor efficiency. The low price also implies a minimum of insurance services. In addition, when making insurance with a travel agency, a small deductible may be negotiated, which is unacceptable for a Schengen visa. Considering the above, it would be more correct to decide to buy only a ticket from the tour operator.

The third option is to arrange visa insurance at the visa service center or directly at the consulate. The advantage of this option will be a guarantee that the insurance companies offering services here are accredited in the Schengen countries, and, accordingly, the insurance policy will be issued in accordance with all requirements. The downside is the higher price.

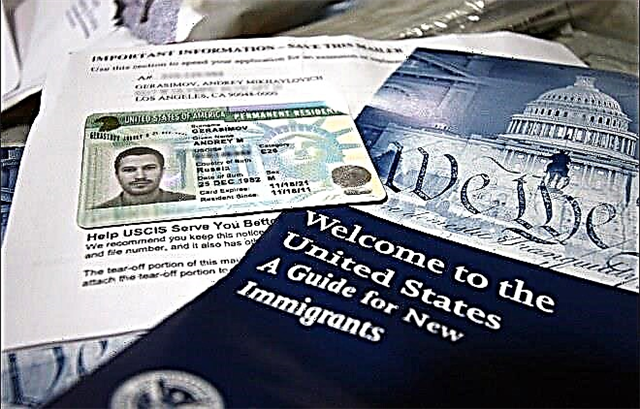

The package of papers required for drawing up an insurance policy is not large. Of the required documents, an international passport, TIN, and civil passport are required. The necessary information - the name of the client, the year and place of his birth, the registration address where the trip is planned, the duration of the trip - are entered into the questionnaire when the policy is issued.

The fact of life, health and property insurance is confirmed by a personal document issued by the insurance company to its client.

The document contains information not only about the insured, but also about the insurer - details, name, contacts of service companies. The insurance object, the duration of the policy, the amount of insurance, insurance premiums, and insurance risks must be specified without fail.

The insurance policy must be signed by both parties.

In recent years, another method of registration has gained great popularity - online insurance.

Online travel insurance

Online visa insurance is available to Russian citizens who are going to travel to the Schengen area on the websites of all major insurance companies.

The advantages of this type of insurance are obvious:

- saving time - you only need a smartphone / tablet / computer with Internet access, and the whole operation takes only a few minutes;

- saving money - no need to negotiate with an agent, paying for his services;

- simplicity;

- Convenience - an electronic policy is equivalent to a paper one, you can load it into a gadget and have it with you at all times.

As an example, consider online insurance for private clients on the website of Sberbank of the Russian Federation - https://www.sberbank.ru/ru/person. Here you can take out an insurance policy for one person or for several, including infants and elderly citizens. The algorithm of actions is simple - several consecutive steps should be taken.

- Go to the Sberbank website, select the "Insurance" item in the top menu bar and hover over it.

- A tab will open in which you should click on "Travel and shopping".

- On the page that opens, click on the green button "Checkout online".

- The Travel Insurance page opens. Here you need to choose a suitable policy for yourself and consistently fill in the columns: the region of the policy (for a trip to the Schengen countries, you should select "The whole world, except for the USA and the Russian Federation"), travel dates (the number of days during which the policy is legitimate will be automatically displayed on the website ) who will be insured - indicate the number of travelers and their age; The site provides for the specifics of issuing an insurance policy when traveling to Finland (check the box "I am going to Finland" and indicate the date of submission of documents), as well as the possibility of issuing a policy for multiple trips - put a tick in the "I want a policy for multiple trips" - in this case, the validity of the document will automatically be 90 days a year;

- choose one of the three options for the amount of insurance coverage - put a tick. All three options (the minimum amount is 35 thousand euros, the sufficient amount is 65 thousand euros and the maximum is 120 thousand euros) provide the same number of services: medical care, transportation of the victim, repatriation, dentistry, visiting relatives, etc., but in each case the amounts will be different. Here you can also choose additional insurance products - luggage protection, participation in competitions, personal lawyer and others;

enter a promo code (if any) to receive a discount.

Clients at this stage have the opportunity to once again familiarize themselves with the insurance terms and conditions at Sberbank.

If everything suits you, click "Checkout".

- On the new page, you should enter information for issuing a policy: last name and first name in Latin letters (according to the foreign passport), date of birth, citizenship, full name, gender, passport data of a client who is a citizen of the Russian Federation. Here you must also indicate the phone number and the current email address to which the policy will be sent. After entering the data, click on the "Continue" button.

- The next step is confirmation and payment. You need to check the information again for errors or typos and, if everything is correct, pay with a bank card.

- You will receive by e-mail a file with an electronic policy, a receipt and contacts for contacting in case of an insured event. The policy can be printed on a printer or saved on a gadget.

Security price: how much does insurance cost

The pricing policy of different insurance companies differs, and the same risks are assessed differently.

The price of insurance for a visa depends on the following factors:

- duration of a trip abroad;

- host country;

- possible risks - engaging in extreme sports, visiting areas that pose a threat to life and health;

- the age of the policyholder - insurance for customers under the age of one year and from 61 and older will cost more;

- the price of a tourist voucher;

- the planned way of arriving at the destination, etc.

So, for example, the cost of an insurance policy with a minimum amount of 35 thousand euros and an additional function - baggage cover, for one person aged 50, who is going to make a 10-day trip to the Schengen area, in various insurance companies will be:

| Insurance Company | Economy. option (rub.) |

|---|---|

| Sberbank RF | 1 337,06 |

| "Uralsib" | 997 |

| Liberty Insurance | 975 |

| VTB | 836 |

| RESO | 800 |

| "Agreement" | 798 |

| "Alpha insurance" | 785.16 |

| Rosgosstrakh | 762.29 |

| Ingosstrakh | 663.2 |

| Tinkoff | 618 |

In each case, the amount is calculated taking into account all the components using a special calculator. It should also be borne in mind that the cost may be affected by bonus programs and discounts from insurance companies, which allows you to save from 5 to 25% of the amount.

The insurance policy required to open a Schengen visa can correspond to one of three rates:

- the minimum package "A" or "Economy" for 30-35 thousand euros includes two or three services: a call to the assistance company, the provision of urgent medical care, transportation to a medical institution;

- tariff "B" or "Optimal" for 60-65 thousand euros: in addition to the listed insurance products, it includes additional ones - child screening, expenses for the arrival and living of a relative, free return home accompanied by a medical worker;

- tariff "C" or "Elite" for 100-120 thousand euros - the most expensive, covers all services of tariffs "A" and "B", as well as additional, such as legal assistance.

At the request of the traveler, additional options can be purchased for any tariff package - “Loss of baggage”, “Sunburn”, etc.Each such service will increase the cost of the policy by 100-300 rubles.

Holders of multiple-entry Schengen visas can save money by taking out an annual insurance policy. This will also allow you not to worry if you need insurance to travel abroad, if you have a visa: in the absence of a policy, border guards simply will not give permission to enter Schengen.

Choosing an insurance company: what to look for

The choice of an insurance company depends on several factors. For many Russians, the price of the policy is of decisive importance. It can be preliminarily calculated using online calculators on the websites of insurance companies. To do this, you just need to enter the necessary data - the duration of the trip, the country of destination, the number of people leaving and their age, insurance risks.

Experienced travelers put more important criteria first - safety and reliability. When choosing an insurance company, help can be provided by official and national ratings of insurance companies. Similar information can be found on the portals Banki.ru, Sravni.ru.

It should be noted that high prices do not always guarantee tourists full protection of their interests, and cheap does not always mean bad.

When choosing an insurer, it is important to pay attention to the fact that not all Russian insurance companies are accredited in the Schengen area. For example, in Estonia, the policies of Rosgosstrakh, Renaissance Insurance, Russian Standard, Sberbank of the Russian Federation, Alfa Insurance, VTB and others are accepted.

Before signing the contract, you should check if the company is accredited at the embassy of the country that issues the Schengen visa.

Most insurance companies in the Russian Federation do not have representative offices abroad, but use the services of partners or assistance companies. It is these partners who undertake the provision of medical assistance, paperwork in connection with the insured event.

In the Schengen countries, these are, first of all, Allianz Global Assistance (former Mondial Assistance), Euro-Center Holding, AXA Assistance and others. Insurance companies that value their reputation try to find reliable assistants. The Global Voyager Assistance (GVA) rating, with which many Russian insurers worked, fell sharply due to poor service, although VTB insurance company continues to cooperate with GVA.

What Russians most often ask

Citizens of the Russian Federation, especially those who travel to the Schengen countries for the first time, want to receive as much useful information as possible in order to be ready to respond adequately in the event of a particular situation. We will try to answer the most frequently asked questions.

- What to do in case of an insured event?

The main rule in this situation is not to panic. The policy contains the telephone number of the assistance company, which you should urgently contact. To receive assistance, you must indicate: the full name of the insured, the policy number, the name of the insurance company, the location of the victim, information about the insured event, and the contact phone number.

If possible, duplicate all this information by e-mail.

Write down the address of the medical facility to which you should contact, and what transport to get there. Travel documents indicating the route and fare should be retained.

In a medical institution, you should pay only for services agreed with the assistance, keeping receipts for payment for treatment and medicines, bills for medical services, hospital discharge with a diagnosis, etc. The papers must be signed and stamped.

All these documents, together with an application for reimbursement of expenses for an insured event, must be submitted to the insurance company within 30 days after returning from the trip. Payment of money in case of recognition by the company of an insured event, as a rule, occurs within 15 working days.

- What is a deductible and is it necessary for insurance in the Schengen area?

A deductible in insurance is understood as a part of the loss that is covered by the insured person. If the contract specifies a deductible of 50 euros, the insurance company will compensate the victim with 450 euros for treatment costs of 500 euros. Medical insurance for a Schengen visa must be without a deductible.

- What should I do if I made a mistake or entered the data incorrectly when purchasing the policy?

If, when drawing up the insurance contract, a mistake was made or incorrect information was indicated, this may serve as a reason for refusing to reimburse funds in the future. It would be correct to contact the insurance company's contact center with a request for changes.

It is also required to provide copies of the insurance policy, payment receipt, passport. The decision will be made within 10 days.

- What to do if the visa officer does not accept the electronic policy?

Electronic policies are equivalent to paper ones, in most cases they do not require a printout - you just need to present it on the screen of the gadget. If the visa officer refuses to accept the electronic policy, the reason is most likely a non-compliance with the requirements of the insurance itself: the amount of coverage is less than 30 thousand euros, there is a deductible, the terms do not coincide. If all the conditions are met and the insurance meets the requirements of the European Parliament, you should firmly insist on your case.

Conclusion

It is impossible to apply for visas to the Schengen zone without providing medical insurance. The policy must be valid for at least the planned period of stay abroad. The minimum coverage of such insurance, according to the decision of the European Parliament and the Council of the EU of 13.07.2009, must be at least 30 thousand euros.

You can conclude a contract with an insurance company in one of the ways - come to the company's office in person, buy insurance at a travel agency along with a tour, purchase a policy at a consulate or service center, or use an online service.

An electronic policy has the same legitimacy as a paper one. It is necessary to approach the choice of insurance products with all responsibility, discarding unnecessary ones and leaving those that may actually be needed.