Social assistance for those who cannot feed themselves independently in old age, due to disability, loss of a breadwinner is an important issue for millions of people around the world. The Spanish authorities have managed to create a reliable pension system that helps the disabled to constantly feel the help and protection of the state. And although pension in Spain in 2021 is inferior in size to payments in Germany, Spanish pensioners have the opportunity to live peacefully and comfortably.

Peculiarities of pension provision in Spain

Much is being done in Spain to ensure that every resident of the country feels under the protection of the state and does not doubt that life is just beginning in retirement. The main requirements for men who want to apply for an old-age pension are 67 years old, for women - 65 years old, work experience with payment of social contributions from 15 years. If these conditions are met, you can count on decent support in old age.

Pensioners in Spain receive free medical care, buy medicines with a discount of 60 to 90%.

Travel by public transport is reduced or free, depending on the region. Spanish retirees can also visit clubs of interest in each city, rest by the sea, excursions paid by the state, special discos for the elderly.

What affects the procedure for calculating pensions

The size of the pension is influenced by several factors: retirement age, length of service, wages, and the amount of contributions to social insurance funds.

As a rule, Spaniards retire at 67 (women at 65), but you can leave work for a well-deserved retirement earlier - at 61.

This procedure exists for those who, after being fired from work, stood at the labor exchange for six months. At the same time, payments for such pensioners will be almost 10% lower than for those who retired at the age of 67.

The following amounts of benefits from the state have been established:

- If a resident of Spain retires before reaching the official retirement age, his pension will be 7,774 euros per year. If there is a spouse or spouse as a dependent, the amount of pension benefits will increase to 9,611 euros.

- Upon retirement in the prescribed 67 years, the amounts will be 8,311 and 10,225 euros per year, respectively.

- The amount of the disability benefit reaches 11 825 or 15 383 euros per year if there are dependents.

Who is eligible for benefits when calculating pensions

For some employees, there are preferential conditions for retirement. First of all, this applies to those whose nature of work was particularly difficult - miners, sailors, railway workers, agricultural workers, as well as people who have chosen unusual professions - actors, bullfighters, artists.

For these categories, the retirement age is legally reduced. For example, for workers of ships of all types, fishermen and whalers, workers of oil and gas offshore platforms, those who worked in freezers, special coefficients from 0.10 to 0.40 are set, which reduce the required retirement age.

How do accumulative and personal pension funds work?

Although the average pension in Spain in 2021 reached almost a thousand euros, they are not always enough for all expenses, so the Spaniards often take the opportunity to accumulate an additional amount for old age under the Plan de Pension state funded program. Its participants monthly donate to the fund at the chosen bank a fixed amount for each - from 50 to 100 euros.

You are allowed to invest your savings in investment programs, which is more profitable than just saving for old age, but more risky, because you have to take into account several factors: the reliability of the fund, the size of the commission.

By saving relatively small amounts monthly, in old age the Spaniard receives a significant increase in his pension.

The funds accumulated in this way are inherited, and in case of severe industrial injury or unemployment, they are paid earlier than the specified time.

The state is developing such programs in every possible way - it provides tax incentives, co-finances savings, but hardly a fifth of all residents of Spain participate in accumulative insurance.

Registration and size of pension

The Spaniards do not have the highest, but rather large, pension benefits in the EU. The minimum is from 636 euros, the maximum is more than 2.5 thousand. In 2021, the average pension was € 908. The pension is paid monthly, and in June and December the state makes one additional payment.

The old-age benefit is calculated in the amount of approximately 60-100% of the salary.

The amount of contributions to the social insurance fund and work experience are also taken into account. When calculating, the average earnings over the past 15 years are taken: what a person actually received in the last 2 years, and the salary for 13 years, indexed to take into account inflation.

In practice, those who have worked for only 15 years will receive 50% of the salary, with 25 years of experience - almost 900 euros. After 35 years of service, payments for each year worked increase by 2%. Today the richest retirees are programmers, financiers, company managers, qualified specialists in other fields.

There are differences in the amount of benefits not only for different social groups, but also by gender, by place of residence. Thus, payments to men are greater than to women; in Madrid and Barcelona the average pension level reaches almost 1,064 euros, and in Galicia, Extremadura - 759 euros.

How the state supports non-working

To receive support from the state in case of unemployment, you must have work experience in Spain and pay social insurance contributions. The amount of the benefit depends on how long the person has worked, and is assigned to people from 15 to 66 years old.

The law provides for unemployment benefits for Spaniards if they have worked for at least a year in the previous 6 years and are registered with the employment service.

The usual amount of the benefit is approximately 70% of the earnings in the previous job. If the unemployed has children, the allowance can be up to 80% of the earnings.

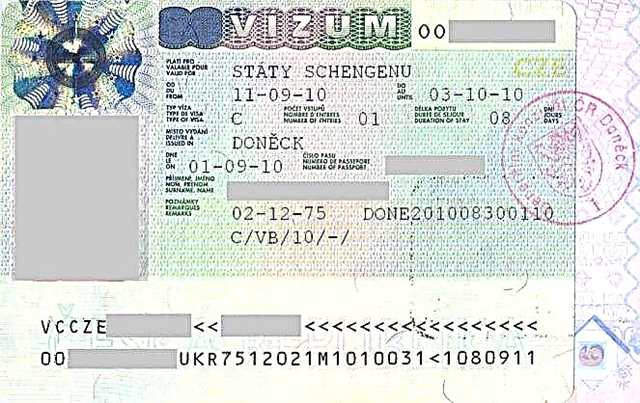

Spain has bilateral agreements on social assistance to non-working people with Russia and Ukraine, therefore, for emigrants from the CIS who did not work in Spain, in problem situations - with a sudden disability or loss of a breadwinner - a minimum allowance is provided.

Is it possible for a foreigner to receive a pension in Spain

You should not count on the fact that, having arrived in Spain, you have the right to immediately apply for a pension. In recent years, the retirement age for the Spaniards has been raised, and the rules for assigning pensions to Russians and Ukrainians have been tightened.

To receive a Spanish pension, you need to come to the country as able-bodied, get registered, legalize and work for 5 years.

Accommodation at the expense of relatives must be documented. Legally, the experience at home and in Spain is summed up, a general pension is assigned. It is possible to start petitioning for a pension only 5 years after reaching retirement age.

The appointment of a minimum old-age pension is possible, even if a person does not have work experience in Spain, but for this you need to live in the country for at least 10 years on legal grounds.

Conclusion

A wonderful climate, good working conditions, a chance to ensure the future of children - all this attracts our compatriots to Spain. But when moving to another country, it is important to carefully consider the nuances of processing payments at retirement age.

Pensions in Spain are received only by those who work and live in this country legally, had at least the minimum period of employment, deducted social benefits. If the residence and work in Spain is not documented, the pension is not due.