Russian business has been interested in Czech real estate for a long time. This is understandable: thanks to the influx of tourists, regardless of the season, commercial real estate in the Czech Republic is constantly growing in value. Its investment attractiveness does not raise doubts among Russian investors - several years of ownership of real estate will bring the owners considerable income. Moreover, Czech real estate can not only grow in value, but also generate commercial income. Today we will take a closer look at what types of real estate are found in the Czech Republic (CR) and how you can invest in it.

Commercial real estate market in 2021

Domestic and foreign investors trust the stability of the Czech economy, continuing to invest and creating favorable conditions for the development of the commercial real estate market. In 2021, it continues to experience a long-term boom, and experts make similar forecasts for 2021.

Over the past years, the Czech real estate market has grown at a breakneck pace. The rise in prices depending on the type of object in annual terms could be calculated in tens of percent. The reason for this was the high growth rates of the domestic economy, the inflow of foreign capital and the availability of mortgage loans. But economic forecasts for 2021 promise a slowdown in the growth of the Czech economy, which will inevitably affect price dynamics.

More and more people want to buy commercial real estate in Prague. Foreign investors annually invest tens of billions of crowns in it. The record year was 2021, compared with 2017-2018, they show a decrease in the number of transactions. But this is not due to the reluctance of investors to invest money: just fewer and fewer people want to sell their real estate. There is a typical shortage - business demand exceeds supply from sellers.

The reason is that investors do not want to get rid of a profitable and reliable asset. Everything is obvious: the growth in real estate prices, the rate of which exceeds the average European rate, reliably protects and increases the investment. Plus, the profitability from renting out such objects is much higher.

If you buy an office building in the West of Europe, for example, in Paris or Berlin, its profitability in relation to the price in annual terms will be no more than 3.5%. In Prague, this figure is 4.85-6%.

The demand for industrial facilities is also high. One of the advantages is the ability of the investor to receive support from the local authorities. Especially if the object he is buying is abandoned, located as far from the capital as possible and will create jobs for the Czechs in the future.

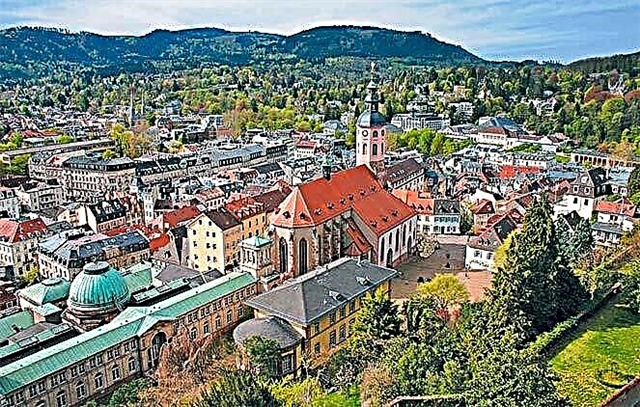

Similar programs have already been implemented in Karlovy Vary, where foreign capital (the lion's share of which is of Russian origin) actually brought the resort back to life.

Today the market is still dominated by Prague properties. Brno, Ostrava and Pilsen also have high development prospects.

Types of commercial real estate in the Czech Republic

As in any other country, the Czech real estate market offers buyers countless options for real estate. There is a buyer for each product here: recently, especially, demand has been growing for objects not in the most prestigious places, and not only in the capital. Moreover, the variety of real estate is really impressive.

Czech realtors identify such popular types of commercial properties as:

- old tenement house - an apartment building in which housing is rented to guests;

- industrial facilities, factory halls and old workshops in the suburbs being reconstructed into loft housing;

- old hotels for reconstruction;

- land plots for warehouse construction;

- operating hotels and hotel complexes;

- auto repair shops, car washes, gas stations, tire changers and other car service facilities;

- cafes, restaurants, bistros, other public and street food establishments;

- shopping areas, in particular, shops, souvenir shops, MAFs;

- private hostels, hostels and other existing business facilities;

- land plots for large residential construction and the construction of new buildings;

- technological and innovation parks;

- industrial zones for the location of production and others.

Each of these objects assumes its own investment strategy. Let's dwell on them in more detail.

Commercial real estate investment options

Considering the categories of the most common commercial properties, we can conditionally distinguish at least 4 strategies for investing in them. It all depends on the goals that the investor pursues, but one way or another he will have to choose one of the options:

- Passive investing. We are talking about the purchase of such objects as a warehouse, a shopping center, individual offices or retail premises, individual apartments or operating apartment buildings. This is the most reliable investment option using the capital freeze method. It will generate a small but steady rental income.

- Investing in reconstruction and development projects. We are talking about the acquisition of old hotels, abandoned industrial areas for housing construction, old apartment buildings for reconstruction, land plots. Such projects are based not only on the real estate for sale, but also on the plan for its further use in commercial activities. For these purposes, major repairs, reconstruction, the formation of several new objects from one, and so on are carried out.

- Investing in a ready-made business. We are talking about the purchase of hotels, existing shops and supermarkets, restaurants, car repair shops and other businesses based on real estate. This option presupposes not only the availability of capital for investment, but also the investor's understanding of the essence of the business, as well as the desire to actively participate in its development and management.

- Large production and investment projects. We are talking about an impressive multimillion-dollar investment that requires close cooperation with not only local authorities, but also state authorities.

Dynamics of prices for commercial objects

The dynamics of real estate prices is the main reason why foreign investors are ready to continue to actively invest in the Czech Republic. Over the past five years, growth has not stopped, reaching a peak in 2021 - then prices rose by an average of 20%. This was driven by economic growth, low mortgage interest rates, accumulating demand, and high yields.

In 2021, the growth in prices maintained positive dynamics, although it slowed down significantly. As a result, by the beginning of 2021, prices for movable property, depending on its type, increased by 30-35% compared to 2021. For example, in Prague, the average cost of 1 m2 of commercial space excluding VAT exceeded 4 thousand euros.

Many experts began to call everything that was happening only as a "price bubble", and the prices for objects themselves - unreasonably inflated.

Fearing the consequences, the Czech Central Bank introduced a number of restrictions on mortgage loans during 2017-2018, regulating their size and raising rates. This gave a result and allowed us to stabilize growth.

Against the backdrop of these measures, many experts say that property prices have stopped and will not rise anymore. But is it possible to believe this, given the tremendous growth in demand from foreign investors and the extremely low number of offers from sellers ?!

What objects are worth paying attention to

Czech real estate should always be viewed from an investor's point of view, assessing the potential return that it can bring. The most reliable in this regard are passive investments in residential real estate.

There are really many offers on the market, but finding a worthy object is not an easy task. To do this, it is recommended to pay attention not only to Prague real estate, but also to objects in the provinces. They will be cheaper, but they can also bring a good income - 4-6% of the cost per year.

Old objects for reconstruction and housing construction are no less popular. Migration, income growth and the growth of the Czech population have led to a catastrophic shortage of residential real estate. Therefore, with the rapid implementation of such projects, the profitability can be up to 35% in 2-3 years.

If your attention is attracted by a ready-made business, before entering into a transaction, make sure that you are buying not only the company, but also the real estate on which it is located. In the Czech Republic, it is customary to sell not the object itself, but the business and the investments made in it, transferring the lease right to the buyer (for example, if it is a restaurant). The object itself, as a rule, is not owned by the enterprise.

When buying a ready-made business, pay attention to the annual profit indicated by the sellers. It directly depends on the location of the object.

For example, if this is a cafe in the center of Prague, it can generate an annual income of 150 thousand euros. But if this is a restaurant in a residential area, no matter how much the seller says, the income will hardly be more than 50-60 thousand euros.

For a qualified selection of an object, use the services of a real estate agency or a private realtor. Please note that this activity is not licensed in the Czech Republic, therefore base your choice on recommendations and reviews.

Property purchase taxes

From 2021, when purchasing real estate in the Czech Republic, the buyer must pay the transfer tax (Daň z převodu nemovitosti). Its size is 4% of the value specified in the contract, or the value of the market assessment made by a specialist - the higher price is taken as a base. You need to pay tax within three months from the date of registration by submitting a declaration to the tax authority.

In addition to this payment, the owner pays an annual property tax (Daň z Nemovitosti). To pay it, you must declare the purchase by submitting a declaration to the tax authority by the end of January following the transaction.

The size of the tax and its rates are set depending on the type of real estate and its purpose. In addition, local administrations can set multiplying factors. For a rough calculation, use this calculator.

Real estate purchase procedure

Anyone can buy Czech real estate; for this he does not need to apply for a residence permit and other permits. After the desired object has been found, the registration procedure usually takes three to four days and includes several mandatory stages:

- Reservation and deposit. Having found the desired property, agree with the buyer on an oral reservation of the object for a few days. They will be enough for your representative to check the “cleanliness” of the object, in particular, to make a request to the real estate cadastre (Katastr nemovitostí) and receive an extract from it. If everything is in order, a deposit agreement is drawn up, which is up to 5% of the transaction value.

- Conclusion of a sales contract. It is drawn up in Czech and certified by a notary. If necessary, translation into Russian is done in the organization of court interpreters.

- Payment for the transaction. All money transfers in the Czech Republic are usually made in Czech crowns. The traditional method is bank transfer, for which it is advisable to open an account with one of the Czech banks. In the future, it will be needed to pay for utilities and receive funds for rent.

- State registration of the new owner. The final stage is the submission of the contract and the application for registration of the new owner of the object. At this stage, the Real Estate Cadastre blocks any real estate transactions for a period of 21 days, during which it considers the legality of the transaction. The entire registration can take up to 45 days.

Renting an object as an alternative

If the main goal is not investment income, namely the conduct of commercial activities in the Czech Republic, leasing of commercial real estate in the Czech Republic can be considered as an alternative to buying. This option allows you to save on the initial investment by putting them into business.

In Prague, you can find very attractive offers for long-term lease of commercial premises up to 150 m2, the monthly cost of which ranges from 15 to 35 thousand kroons (600-1350 euros). In the regions, prices are, respectively, an order of magnitude lower.

Conclusion

Czech business real estate continues to be one of the most popular investment vehicles, according to Russian citizens. This is facilitated by the dynamics of prices for objects, the cost of which has slightly increased by 20-35% over the past. Similar trends continue for the period 2018-2019.

The huge range of commercial properties on the Czech market allows you to implement different investment strategies, from passive investments based on rental income, to large investments in renovation and large-scale construction.